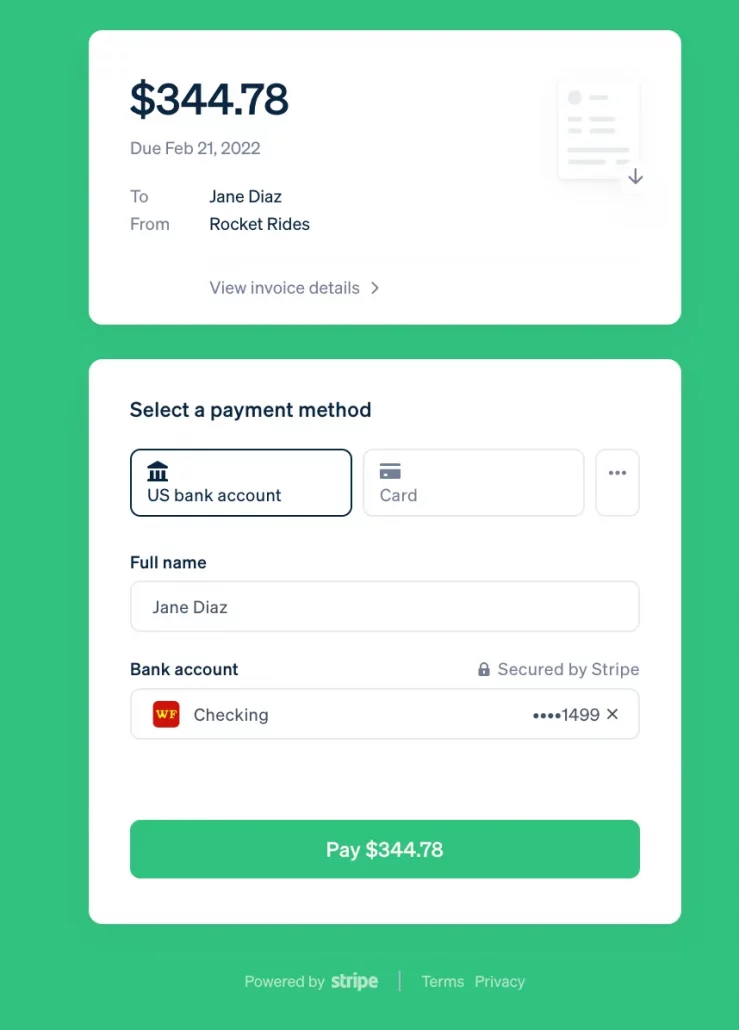

Stripe and AirBNB have announced that AirBNB guests can now pay using their bank account through ACH. This payment method uses Stripe Financial Connections products under the hood.

How this works

In order to add their bank details to AirBNB customers now need to log in to their bank using bank account credentials.

Users can’t just add their bank account by providing their routing and account numbers to make a payment. NACHA requires merchants to validate the bank account before making a payment to reduce payment fraud.

There are several options available to perform the validation. The most traditional way is by charging a random minimal amount. Customers will see transactions in their bank statements and will specify this amount in the UI. This method typically takes a few days to complete, so it is not very convenient for the customer and causes delays in receiving the service.

Another validation method is through a validation partner. Today, Stripe provides a service (public beta) called Stripe Financial Connections, allowing shoppers to validate their bank account information by providing only bank account credentials.

Why it is a big deal

Payments using bank account credentials are popular all over the world. In Germany alone there were 11 billion SEPA transactions in 2021. But direct bank transfers are still a little bit unusual for a regular US customer.

Transaction fees are significantly lower for bank transfers compared to credit cards. This is one of the reasons why bank transfers (ACH) are extremely popular for B2B transactions.

For B2C transactions bank transfers are popular in categories where fees are critical. A Bank account is usually used as a primary payment method in financial services (SoFi, Robinhood), P2P transfers (Venmo, CashApp, Zelle), subscription services (Zoom), or utility payments.

Traditionally, processing bank transfers requires several business days which delays shipment or service to the customer. This is why accepting bank transfers for transactional business is highly inconvenient. New services like Plaid or Stripe Financial Connections will help to process these payments much faster. AirBNB is one of the first companies that added a bank transfer as a payment method for transactional business. We can expect an expansion of bank transfer payment methods with more merchants in the future.